21 Oct 2025

Kath Galpo

21 Oct 2025

Kath Galpo

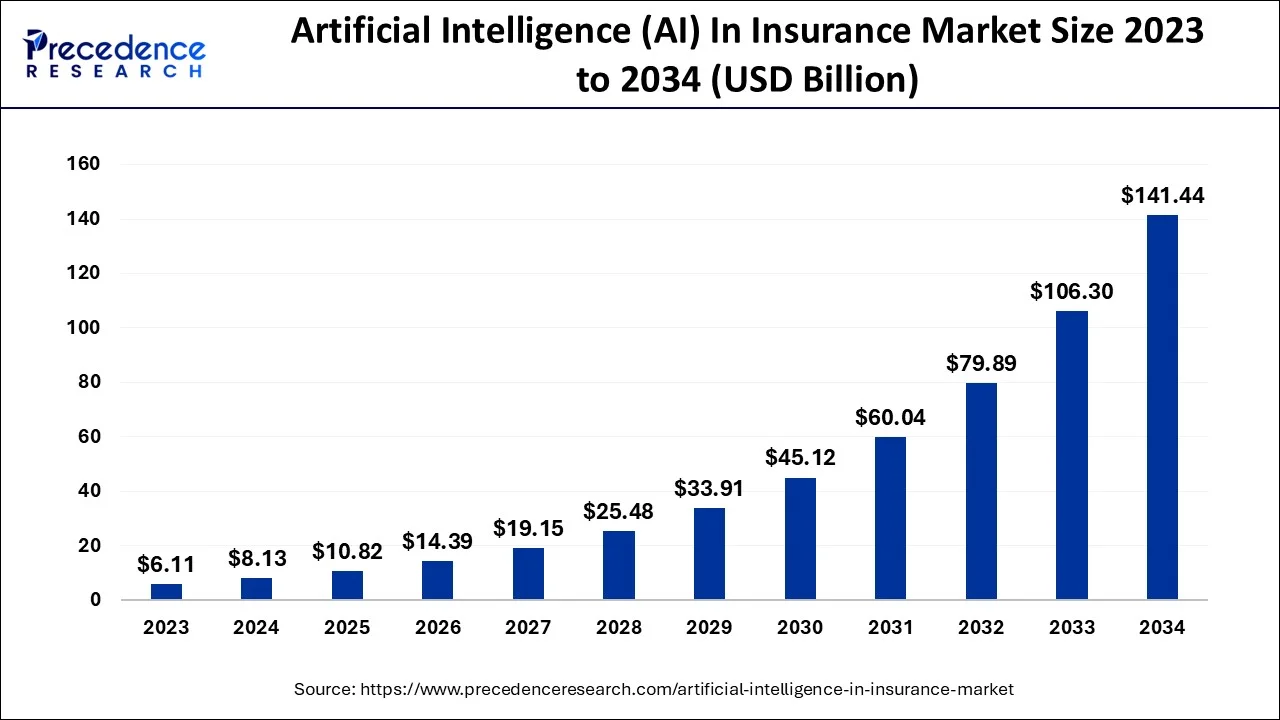

The insurance industry was once full of excessive paperwork, endless communication loops, and unclear processes until chatbots in insurance arrived. These conversational AI chatbots for insurance act as virtual assistants to handle claims, provide guidance on policy selections, and answer questions 24/7 without being tired. According to a recent study, the worldwide AI in insurance market size reached $10.82 billion in 2025 and is expected to grow to $141.44 billion by the end of 2034.

Image Source: Link

These insurance chatbots use generative and conversational AI to manage the entire insurance process. It includes marketing to customer support, not just answering the basic FAQs. Chatbots in insurance craft and share answers via natural and human-like interactions. These AI chatbots answer policy questions, file claims, and send reminders, and they make the insurance experience quicker, simpler, and more human-like.

In this blog, we will learn about how insurance chatbots are transforming customer service and claims by providing customers with a conversational experience.

An insurance chatbot acts as a virtual assistant and automates customer interactions across various channels such as websites, apps, and messaging platforms. It offers 24/7 support to enhance customer satisfaction or even work as an AI SMS chatbot. By using conversational AI for insurance, these bots can understand customer intent, reply naturally, and help with tasks such as providing policy information, filling claims, and sending premium reminders, among others.

However, keep in mind that not all chatbots are the same. There are mainly two types of chatbots.

Let’s understand the difference between the two with a simple comparison.

| Feature | Rule-Based Chatbots | AI-Powered Chatbots |

| How they work | They follow pre-set rules, scripts, and fixed decision trees. | These chatbots use artificial intelligence (AI), natural language processing (NLP), and machine learning to understand customer intent and respond intelligently. |

| Response type | Limited to specific keywords or buttons. For example, if a user types “Renew Policy,” it gives a fixed answer or link. | They can understand context, tone, and even misspelling for natural conversations. For example, if a user says, “Hey, I think my car insurance is expiring soon,” it understands the intent and replies with renewal details. |

| Learning ability | It cannot learn on its own. Require manual updates | Constantly learn from user interactions and improve responses over time. |

| Complex query handling | It is challenging for them to handle unexpected or open-ended questions. | These chatbots can handle complex queries and provide relevant, human-like answers. |

| Customer experience | Functional but robotic | Conversational, natural, and human-like |

| Best use case | Simple FAQs, basic policy info, or lead capture | Advanced customer service, personalized recommendations, and claim assistance. |

Put simply, rule-based chatbots are like guided menus, while AI chatbots act like smart virtual assistants who actually understand what you’re saying.

Insurance chatbots are digital assistants that never sleep, making them available to assist customers 24/7. Here are a few of their key benefits.

Human agents work fixed hours, whereas chatbots are available 24/7. Whether it is midnight or early morning, customers get instant help. This constant availability helps insurance companies build stronger relationships and build trust.

For example, if a customer forgets his policy renewal date. He messaged the chatbot at 11 PM and immediately got the renewal link.

In the traditional method, the claim process involves multiple forms, emails, and long waiting periods. However, with chatbots in insurance, the claim process becomes faster and simpler. A chatbot can collect necessary details, verify documents, and track claims. status, everything in real time. This automation helps reduce errors and obstacles that are common in manual claim handling. According to IBM, businesses that use AI-driven chatbots can reduce claim processing time.

For example, instead of waiting for a long time or navigating complex websites, a customer can quickly file the car accident claim by interacting with the chatbot. It saves time for both the customer and the insurer.

Chatbots generally use consumer data, like interaction history, policy details, etc., to offer tailored experiences.

For example, if a customer returns, a chatbot can greet him with “Hi John! Your car insurance renewal is due in 10 days. Would you like to renew it now?”

This type of personalized message can increase customer engagement and build loyalty.

It is quite expensive to hire and train a customer support agent. Chatbots help automate repetitive tasks, such as answering FAQs or policy lookups, which reduces the need for large customer service teams. Chatbots can easily handle thousands of inquiries, allowing insurers to scale their service during peak periods, like natural disasters, without incurring additional costs.

Each chatbot interaction generates data that can reveal customer preferences, service gaps, and common issues. Through chatbot analytics, insurers can identify trends like FAQs, claim types, and adjust their offerings accordingly.

For example, if many customers inquire about coverage for natural disasters, insurers can use this data to advertise relevant policies or create new ones.

Insurance chatbots can easily integrate with insurance marketing tools, CRMs, and SMS insurance systems to send reminders, updates, and promotional offers.

For example, an AI SMS chatbot can automatically send SMS like “Hey Emily! Your health insurance is expiring in two days. Click here to renew instantly. ”

This type of multichannel integration ensures consistent and proactive communication.

According to a study by Uberall, 80% of users report a positive experience through AI chatbots. They are truly transforming customer interactions. In the insurance industry, companies handle thousands of queries on a daily basis. In that, chatbots help provide faster responses, reduce wait times, and improve customer satisfaction. Let’s check out how insurance companies are using chatbots in real-world scenarios.

Generally, customers have simple questions such as:

“What does my policy cover?”

“How to change my address?”

“When does my premium payment date expire?”

There is no need to call customer care for such questions. Users can chat with the bot and get instant answers.

For example,

Lemonade Insurance uses an AI chatbot named “Maya” that answers FAQs, issues policies, and handles claims within minutes.

Image Source: Link

These days, you don’t have to fill out long forms to get an insurance quote. Chatbots can now gather basic details like age, location, insurance type, or instantly provide a personalized quote. This type of automation saves time and improves lead conversion rate.

Filing a claim is quite stressful. However, chatbots can simplify it by collecting details. For example, after the accident, a chatbot might ask, “Please upload pictures of the damage.”, “What was the date and time of the accident?” After that, it processes the data, generates a claim number, and keeps the customer updated through SMS or email.

Insurance companies can send automated reminders for renewals, provide quotes for updated coverage, and even process renewal transactions.

Lead generation is quite time-consuming. Chatbots can act as friendly lead-generation assistants. When the visitor visits an insurer’s website, the chatbot can ask, “Are you looking for the best health coverage plan?”

Once the visitor responds, the chatbots gather information and share it with the sales team for follow-up. It can then send personalized messages to keep the lead warm.

Insurance chatbots can analyze existing policies and recommend some add-ons or upgrades. For example, a customer who has car insurance may receive a message like “Would you like to add roadside assistance for just $5 more per month?” This type of gentle and personalized approach can boost sales without sounding pushy.

It is important to keep yourself aware of the latest regulatory changes. Chatbots can inform customers of new laws or regulations that affect their policies. It can guide them through required updates to remain compliant, which ensures both the customer and the insurer are up-to-date with legal requirements.

After resolving the query, the chatbot can ask, “How was your experience today?”

Chatbots help insurers to collect customer feedback in real time so that they can use it to improve their service continuously.

There are so many options available. Therefore, choosing the right policy can be difficult. Chatbots help customers compare multiple insurance products and highlight key differences and benefits.

AI-powered chatbots can analyze a large volume of data quickly as compared to humans. Therefore, they can easily identify potential threats that might otherwise go unnoticed. They can identify suspicious claims based on inconsistent information, request additional documents when a fraud indicator appears, and easily identify unusual patterns during the application process. After all these, they can notify human investigators about potential problems.

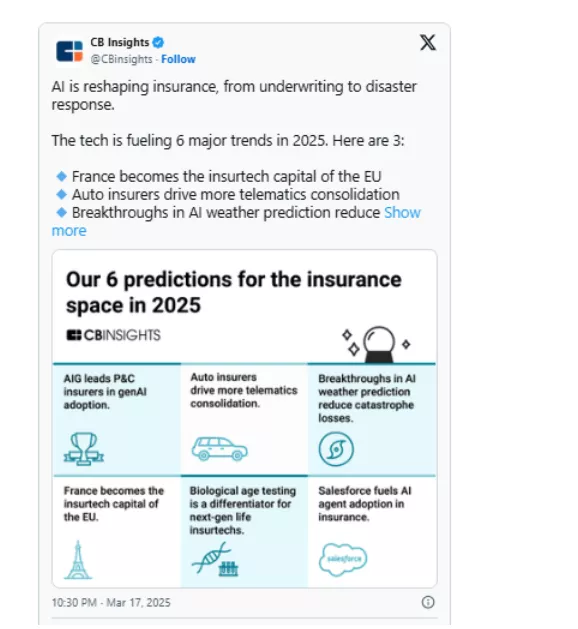

Recently, CB Insights shared some key predictions on X for the insurance industry in 2025.

Image Source: Link

As predicted by CB Insights, AI will positively transform the insurance industry over the next few years. Purchasing policies will become more streamlined, claim automation will manage nearly half of the processing activities, and underwriting for most products will undergo significant changes. Blockchain and augmented intelligence will improve security, claim processing, and fraud prevention. As the chatbot continues to advance, the right provider can help you stay competitive, deliver a quick, smarter customer experience, and adapt to industry shifts.

The insurance industry is about delivering speed, simplicity, and empathy at every customer touchpoint. Insurance chatbots make this possible by transforming complicated processes into smooth conversations, helping customers compare policies, and assisting them during claims with support that is just one message away.

When combined with conversational AI, chatbots offer a 24/7 customer experience that builds trust and loyalty. This is where Textdrip can help. It is more than just a text messaging platform; it is an automated SMS marketing platform that is specifically designed to simplify the insurance workflows.

Textdrip enables insurers to automate policy updates, renewals, and payment reminders through personalized SMS. The platform also allows insurers to utilize AI-powered chatbots for prompt customer inquiry resolution, connect marketing, support, and claims under one unified system, and integrate existing tools to establish a consistent communication strategy.

Ultimately, Textdrip helps insurance teams work smarter, ensuring customers get quick responses, personalized assistance, and a hassle-free insurance journey.

Book a Textdrip demo now and learn how to deliver exceptional customer experiences.

Chatbots guide users through the claims process step-by-step, eliminating long forms and phone calls, and provide instant status updates anytime.

Companies like Allstate, GEICO, and Lemonade use chatbots to answer questions, process claims, and improve customer service speed.

Chatbots send automatic reminders for upcoming policy renewal, billing statements, and even let customers complete renewals directly within the chat.

Studies show that over 70% of users prefer chatbots for quick answers and 24/7 help. The trend shows growing trust and satisfaction with AI in the insurance industry.