30 Oct 2025

Philip Portman

30 Oct 2025

Philip Portman

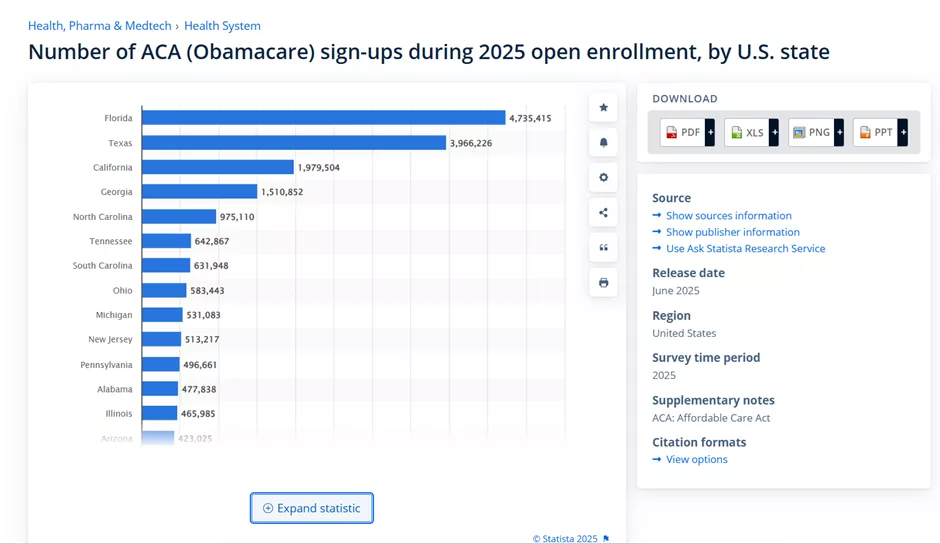

As of June 2025, there were around 4.73 million ACA (Affordable Care Act) sign-ups in the US. Open enrollment time is hectic for health insurance agents. Each year, a specific time window opens for US citizens to enroll, switch plans, and receive subsidies on various health insurance options. It is a golden opportunity to generate high-quality leads. However, due to high competition, you need smart strategies to attract the right prospects.

Image Source: Link

This blog highlights how health insurance agents can increase lead generation during open enrollment. Also, we will discuss how an automated SMS marketing platform like Textdrip can help you capture real-time insurance leads effectively.

However, before diving deep into it, let’s first understand what open enrollment is.

Open enrollment is the specific time period when individuals and families can enroll in a health insurance plan or renew their coverage for the next calendar year. Additionally, individuals can change plans or purchase a new insurance plan via the public health insurance exchanges, which were created by the Affordable Care Act. This ensures that families and individuals don’t have to wait until they get sick to get health insurance. This window also prevents individuals from switching their current plan to a more comprehensive policy before undergoing an expensive medical procedure.

During this period, customers search for plan benefits, premiums, and deductibles, subsidy eligibility, and provider networks. Therefore, health insurance agents have a narrow but powerful window to reach their prospects.

This year’s open enrollment 2026 coverage will run from November 1, 2025, to January 15, 2026. However, individuals must enroll by December 15 in most US states if they want their insurance coverage to start on January 1. States that have public health insurance exchanges can have slightly different open enrollment dates. Medicare open enrollment runs from October 15 to December 7, and another limited open enrollment period runs from January 1 to March 31.

Open enrollment is important because during that time, your target audience is most motivated. They are not casual visitors to your website but people who are actively looking for solutions. Here is why Open Enrollment is important for lead generation.

| Key Reason | Description |

| High-intent audience | Prospects are already looking for insurance, which makes them warmer leads. |

| Time-sensitive decisions | Most people tend to postpone until the window opens, which creates a sense of urgency. |

| Opportunity to stand out | Many providers are competing during this time, so proactive engagement helps you capture attention. |

In short, it is the perfect time to capture real-time health insurance leads.

Health insurance agents face many challenges, even though they have high-intent prospects when trying to generate leads. Here are a few challenges.

| Challenge | Why It Matters | How SMS Automation Helps |

| High Competition | Everyone tries to reach prospects at the same time | SMS is quick and highly personal, which helps health insurance agents stand out. |

| Short Decision Window | Generally, people wait until the last minute | When you send automated SMS reminders, it keeps your brand top-of-mind |

| Lead Drop-Off | Many prospects begin the application process but never complete it. | Drip SMS campaigns gently guide them to completion. |

| Compliance Issues | Health insurance marketing has strict rules. | SMS marketing platforms like Textdrip are compliant with 10DLC, TCPA, and effectively manage opt-ins and opt-outs. |

| Data Quality | Old or invalid contact information reduces effectiveness | Quick SMS response validates active leads. Integrating the SMS platform with tools like Landline Remover helps you identify which contact information is valid and which is invalid. |

When you understand these common challenges, it helps you design strategies that overcome them efficiently.

Here are a few strategies you can use to increase real-time health insurance leads during open enrollment.

You should not wait until the first day of open enrollment. Start building awareness weeks in advance through educational blog posts, social media content, SMS campaigns, free tools or guides. Starting early positions you as a trusted resource, so when open enrollment starts, people will consider you first.

You should give prospects something valuable in exchange for their contact information. You can provide them a subsidy eligibility calculator, health plan comparison guides, or a checklist for choosing the right plan. It will help you capture real-time health insurance leads who are genuinely interested.

Every lead is not the same. Therefore, you should use the STP marketing approach and segment your leads based on age, income, subsidy eligibility, geographic location, and existing insurance status. Sending segmented messaging is more relevant and increases conversion rates.

You should opt for a multi-channel approach for outreach. combining email, social media, paid ads, flyers, and events. The key differentiator in this mix, however, is SMS. It is because it offers around a 98% open rate, immediate reach, and two-way engagement.

Highlight deadlines and provide limited-time assistance; you can send automated SMS to nurture prospects without overwhelming them.

SMS automation plays a crucial role in capturing real-time health insurance leads. Here are a few reasons.

SMS Automation ensures that no leads go cold, which is important during the limited open enrollment window.

Textdrip is an automated SMS marketing platform that enables health insurance agents to efficiently and effectively reach their prospects during open enrollment. By using automated SMS workflows, you can send messages that feel one-on-one even when you’re reaching hundreds of people at once. Here is how you can use Textdrip.

Before you send any text message, you must always get explicit permission from prospects. You can use your website, landing page, or social campaigns to capture numbers via a simple opt-in form.

For example,

Here is an opt-in form message that you can use.

Do you want to find the best health plan for your family?

Enter your mobile number to receive quick plan recommendations and updates via text.

Once the customer submits the form, they are automatically added to your Textdrip SMS campaign.

Welcome text messages are your first impression. Therefore, keep them friendly and helpful. Ensure your message is short, polite, and clearly includes an opt-out instruction for SMS compliance.

For example,

You can set up automated follow-up messages using Textdrip’s drip campaign feature. Spread messages over a few days to educate and engage without overwhelming your audience. Follow the best practices for an SMS marketing campaign in crafting your text messages. It helps you stay compliant with SMS marketing regulations.

| Day | Message Type | Example SMS |

| Day 1 | Welcome Message | “Hi Emma, this is BrightLife Health Plans! Thanks for your interest in our health coverage options. Do you want to see plans starting at just $45/month? Reply YES and we’ll send your personalized quote. Text STOP to opt out.” |

| Day 2 | Educational Message | “Hey Emma, here’s a quick tip from BrightLife Health Plans: You may qualify for 100% premium assistance under new state programs. Learn more here – [link]. Text STOP to unsubscribe.” |

| Day 4 | Reminder Message | “Hi Emma, this is BrightLife Health Plans. Open enrollment ends soon! Don’t miss your chance to update your 2025 plan and save on premiums. Need help? Reply HELP. Text STOP to opt out.” |

| Day 6 | Testimonial Message | “Hi Emma, here’s how BrightLife Health Plans helped families save big! Emily from Denver reduced her plan cost by $380/year. Let’s check your options today: [link]. Text STOP to opt out.” |

| Day 8 | Follow-Up Message | “Hey Emma, this is BrightLife Health Plans. We noticed you checked out Silver-tier plans but didn’t complete enrollment. Do you want us to help? Reply YES to chat with a licensed agent. Text STOP to unsubscribe.” |

| Day 10 | Urgency Message | “Hi Emma, open enrollment ends in 3 days! Let BrightLife Health Plans secure your 2026 coverage before it’s too late. Quick quote link: [link]. Text STOP to opt out.” |

| Day 12 | Post-Enrollment Thank You | “Hi Emma, you’re enrolled with BrightLife Health Plans! Your new plan starts January 1, 2026. Need help logging in or finding a provider? Click here: [link]. Text STOP to unsubscribe.” |

This drip SMS campaign offers a personalized experience to customers. Textdrip lets you schedule these messages by ensuring the right message reaches the right person at the right time. Each message includes clear opt-out instructions to meet TCPA and HIPAA-safe marketing practices. If the customer clicks or replies, Textdrip sends them an instant alert or routes the lead to the agent for faster conversation. It helps generate more real-time health insurance leads.

Whenever a customer clicks a link or replies to a message, Textdrip can automatically send a personalized follow-up or assign the lead to an agent.

For example,

Hey Tom, thanks for checking your subsidy options!

One of our licensed advisors at XYZ Health Plans will call you within 10 minutes to review your results.

Text STOP to opt out.

This kind of instant response ensures real-time health insurance leads don’t go cold.

Once the customer signs up, don’t stop communicating. You can send a quick thank-you message along with a short tip to help them use their plan more effectively.

For example,

Do you want to strengthen customer relationships beyond open enrollment season? Send personalized greetings for special occasions like birthdays or anniversaries, or you can even send personalized messages on health observance days like World Heart Day or Diabetes Awareness Week. Textdrip helps you automate these messages through its Event Message feature.

For example,

Birthday Message

Happy Birthday, Sarah!

Wishing you a healthy and joyful year ahead from all of us at CareBridge Health.

We’re here to help you make the most of your coverage anytime.

Text STOP to opt out.

Health-Awareness Message

Hi James, it’s Heart Health Month!

Remember to schedule your annual check-up and keep your heart strong.

Your WellTrust coverage includes free preventive screenings!

Text STOP to unsubscribe.

When you send such event-based messages, it will not only make your customers feel valued but also keep your brand top-of-mind throughout the year. It shows that you care beyond enrollment and policy renewals and keep your customers engaged throughout the year.

Health insurance agents should ensure that no policy lapses go unnoticed. You can automate reminders for policy renewals, premium payments, or upcoming coverage deadlines. It helps clients stay informed and compliant. Textdrip’s Reminder Drip Message feature can help with it.

For example,

These kinds of timely reminders reduce drop-offs and encourage quick action. It ensures customer retention and satisfaction.

This consistent and personalized communication builds trust and increases the chances that customers will renew next year.

Open enrollment is an important period for health insurance agents looking to generate leads. The prospects you capture during this window are highly motivated and ready to make decisions. However, the real challenge is to stand out and ensure timely follow-up.

By using SMS automation platforms like Texdrip, health insurance agents can reach prospects instantly and nurture leads through drip campaigns. They can segment and distribute leads efficiently and convert real-time health insurance leads effectively. It helps them maximize conversion during open enrollment and secure long-term relationships with clients.

Open enrollment lasts for a few weeks, but with the right approach, you can ensure every real-time health insurance lead gets the attention they deserve.

Book a Textdrip demo to experience how it can increase conversions during open enrollment.

Agents should start SMS campaigns early at least 5 to 6 weeks before enrollment begins. They can offer valuable lead magnets such as plan comparison guides or subsidiary calculators. Another approach they can use is segment their audience using STP marketing approach (based on age, income, location, etc.) for sending highly personalized text messages. They can send urgent SMS reminders about deadlines to keep their brand top-of-mind.

Here is how automated messaging platforms support real time health insurance lead campaigns.

Such automated SMS marketing platforms can automate appointment scheduling and send deadline reminders. They ensure SMS compliance with TCPA regulations while maintaining personalized communication.

Following are the signs that show that real time health insurance leads are of high quality.