08 Apr 2025

Nicole Esters

08 Apr 2025

Nicole Esters

Different identifiers govern your business reputation; the two most common are the DUNS and EIN numbers. While investigating DUNS numbers vs EIN, many questions pop into your mind, such as how these numbers work, whether my business needs both, or what if I only have one. Don’t worry! This blog answers all your questions. In this article, we will explain the difference between DUNS numbers for business and EIN, how to get them, and help you find out which one is needed for the A2P 10DLC registration.

So, without further ado, let’s get started.

A2P 10DLC stands for Application-to-Person 10-digit long code. It is the messaging standard in the United States, which lets businesses send SMS and MMS via a 10-digit long code. A2P 10DLC is regulated by mobile carriers, and it ensures high message deliverability, prevents spam and protects consumers.

If a business wants to use A2P 10DLC, it has to register with TCR – The Campaign Registry and provide valid business information. Here is where EIN and DUNS numbers for business come into the picture. Let’s understand these two business identifiers in the next section.

It is the unique nine-digit business identifier Dun & Bradstreet (a business credit bureau) provides to businesses. It stands for Data Universal Numbering System. The standard format of this number is “xx-xxx-xxxx.” This number verifies a business’s creditworthiness, tracks its financial health, and establishes credibility with suppliers, banks, and government agencies. In short, a DUNS number builds a business’s credit profile and reputation in the marketplace. This number is consistent, unique, and persistent even if your company’s structure changes.

Let’s check out why your business needs the DUNS number for company registration in the US.

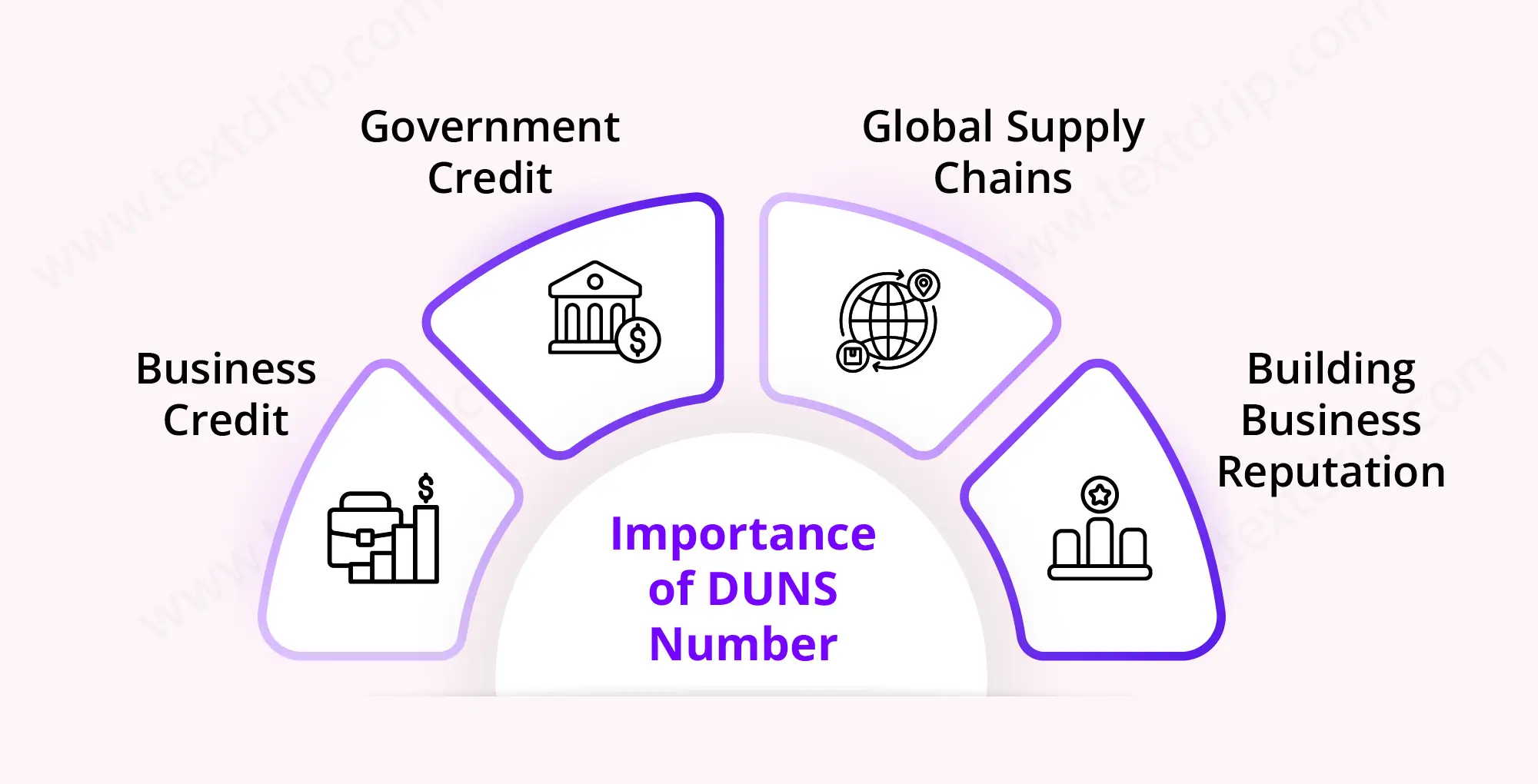

A DUNS number builds business’s credit profile with Dun & Bradstreet. A strong business credit score helps you secure loans, convince investors to invest in your business, and work with larger organizations.

This number is required to bid for government contracts and grants.

It helps build your business identity in the global database. A DUNS number is important for international trade as global companies use it to vet suppliers.

A DUNS number verifies your business’s financial stability and legitimacy and builds your business reputation.

Getting a DUNS number is simple and completely free. You need to follow a few simple steps to obtain a DUNS number.

Image Source: Link

If you want to maximize the benefits of your DUNS registration, you need to keep the following best practices in mind.

EIN stands for Employer Identification Number issued by IRS – Internal Revenue Service. It is also known as the FEIN, or Federal Employer Identification Number, which serves as the TIN or Tax Identification Number. An EIN number is also a nine-digit number but is used for tax purposes. Every year, millions of businesses file taxes, so it is challenging for the tax body and government to track each company.

No matter your business is a corporation partnership, or an LLC company registered in the US, you must have this identification code. Even though the federal government issues this number, it can change if your business changes its legal structure.

If you have formed an LLC, an EIN becomes especially important when the business has multiple members, hires employees, or elects to be taxed as a corporation, as it allows the IRS to identify the business separately for tax purposes.

An EIN number is useful to open business bank accounts, hire employees, apply for business credit, and get permits for your business.

Let’s check out why your business needs an EIN for company registration in the US.

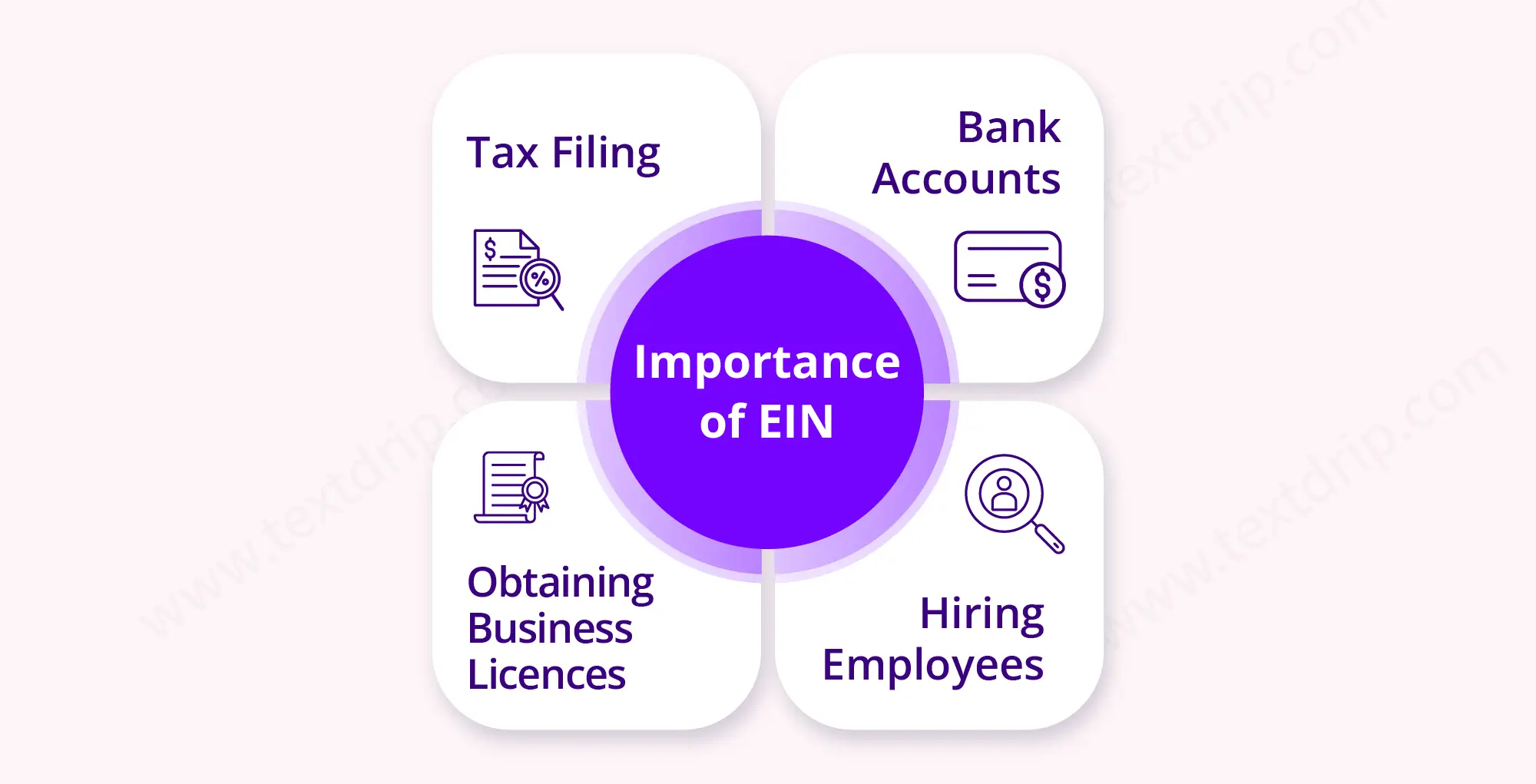

It is used for business tax filings. As an employer, you’ve to pay taxes even if you’ve temporary staff. An EIN number lets you receive credit for these payments. You will receive tax benefits on it as per your unique small business setup.

Many US banks insist that your business must have an EIN number if you want to open a corporate bank account. It will ensure that your customers and vendors that you run a legit company. Also, using a separate corporate account will help you separate personal and business income. Therefore, it makes it easy to prepare taxes.

If you have an EIN number, then it verifies to authorities that you have the proper credentials to run your business. In case you need any permits, licenses, loans, or to open a business bank account, an EIN number is useful.

An EIN number is required to hire employees, pay them, and handle payroll taxes.

Applying for an EIN number is a quick and easy process. Here are a few simple steps that you need to follow.

If you want to get the most out of your EIN registration and maintain regular tax compliance, you need to implement the following best practices.

We have seen that DUNS and EIN are business identifiers, but different authorities issue them. Let’s check out the comparison between the DUNS number and the EIN.

| Feature | DUNS | EIN |

| Issued by | Dun & Bradstreet issues DUNS number. | EIN is issued by the IRS. |

| Length and Format | It is of 9 digits, for example, 12-345-6789 | Just like DUNS, EIN is also of 9 digits. For example, 12-3456789 |

| Purpose | The main purpose of the DUNS number is to build business credit and credibility. | The main purposes of EIN are tax filing, payroll, opening a business bank account, and legal identification. |

| Application Process | You can apply via Dun & Bradstreet’s website. | You can apply via the official website of the IRS. |

| Required For | DUNS number is essential for government contracts, business credit, and vendor relationships. | They are used for hiring employees, paying taxes, and opening corporate bank accounts. |

| Fees | Free, but to fast-track the process, you need to pay $229. | It is completely free. |

| Availability | Global | US only |

| Change | It does not change throughout the life of a business. | It can change if the business structure is changed. |

| Who can apply? | Any business can apply for it. | It is required for businesses with employees. |

| Global Usage | It is recognized internationally for business credit. | It is mainly used within the US for tax purposes. |

| Processing Time | Standard processing time – 30 days. Fast-track process – 1 to 2 days | Immediately, if you have applied online through its official website |

| Public Visibility | It is publicly accessible by suppliers, business partners, and creditors | It is not publicly accessible. Mostly used for IRS and tax-related purposes. |

For A2P 10DLC Registration, businesses must provide their legal business details, including a valid Tax ID. US-based businesses are required to use an EIN. Mobile carriers and The Campaign Registry use it to verify the legal existence of the businesses.

If you’re a US-based business and want to do A2P 10DLC registration, you will require an EIN.

Reason?

It verifies your business’s legal existence for tax and compliance. On the flip side, if you’re an international business which does not have an EIN, you can use a DUNS number as an alternative for registration.

Here are a few situations where the DUNS number is useful.

Generally, US-based businesses prefer EIN for A2P 10DLC registration because:

So, if you’re a US-based business, EIN is a must for A2P 10DLC registration. On the other hand, if you operate internationally, you must check with your messaging provider to see if a DUNS number can be used instead.

DUNS number and EIN both complement each other. They play an important role in the growth and lawfulness of your business. You must need an EIN number for tax-related and legal activities.

On the other hand, if you want to build a strong business credit profile and secure excellent opportunities with government agencies and large corporations, you need a DUNS number.

In short, if you’re a startup or a small business owner, both numbers are important to operate in compliance with US law and build a strong foundation.

In many scenarios, it is beneficial to have both the numbers – DUNS and EIN.

For example,

If you want to apply or have already applied for a business credit card, some lenders may check both numbers. Also, for A2P registration for large enterprises, some carriers may ask for both.

In short, if your business is registered in the US, it is a good practice to have both identifiers.

Here are a few misconceptions about A2P 10DLC registration and ways to avoid it.

If you want to learn more about A2P 10DLC Registration best practices, check our latest blog – 10DLC Registration Best Practices: Making Compliance Easy

Although you have all the skills and expertise to succeed in your business, the legal and financial complexities of running a business can adversely impact your business. However, by registering EIN and DUNS numbers for business, you can set yourself on the right track from the beginning.

Both EIN and DUNS numbers empower business success. Most US businesses need an EIN number for A2P 10DLC registration. However, international businesses may use the DUNS number as an alternative. While these identifiers serve different functions, if you have registered for both numbers, it will provide improved business flexibility, financial benefits, and greater credibility.

If you are confused between the DUNS number vs EIN, you need to consider your business structure, long-term growth goals, and tax obligations. So, understand the difference properly and ensure you have the right registrations. It will help you simplify your business operations and take full advantage of A2P 10DLC messaging. Textdrip is an A2P 10DLC-compliant text messaging tool that helps businesses stay compliant with 10DLC regulations while planning and sending bulk text messaging campaigns. Start using Textdrip today and practice A2P 10DLC-compliant messaging.

DUNS stands for Data Universal Numbering System. It is a unique nine-digit identifier assigned by Dun & Bradstreet (D&B) to businesses worldwide for credit reporting, business verification, and tracking financial activity.

No, you typically only need an EIN for A2P 10DLC registration. The EIN is used to verify your business with The Campaign Registry (TCR). A DUNS Number is not required but can sometimes help establish credibility in business verification processes.

Without an EIN, your registration may be delayed or rejected. Carriers require EIN-based verification to reduce fraud and ensure businesses comply with messaging regulations.

No, once your EIN is registered for A2P 10DLC, it cannot be changed. If you need to update your business information, you may need to re-register or contact The Campaign Registry for assistance.