04 Jun 2025

Dhaval Gajjar

04 Jun 2025

Dhaval Gajjar

Oh no! I forgot my wallet! You realized it when you stood at your local beauty salon’s counter. You’re about to panic when the staff says, “No problem! We have sent you a text. You can pay right from your phone.” Just one click, and it’s done! It is the magic of SMS billing. It makes payment as easy as sending an SMS. Additionally, collecting payments via text is one of the most effective ways for businesses to improve both their inbound cash flow and customer experience.

This blog will explain what is SMS payment, how SMS billing works, and why businesses are increasingly using text payment solutions as a part of their customer experience strategy.

Let’s start with understanding what SMS billing is.

In simple terms, SMS billing involves sending an SMS to your customers, allowing them to pay directly through that message. So, when you use SMS billing, you and your customers don’t need to deal with back-and-forth emails or complex website navigation. A simple text message can let you and your customers complete the transaction, and that can also be done with just a few clicks.

It is important that you understand that SMS billing, transactional SMS, and SMS invoicing are different. Here is a quick comparison between all of them, which will clear your confusion. All three use text messages to communicate with customers. However, their purpose, functionality, and user experience are quite different.

| Feature | SMS Invoicing | SMS Billing | Transactional SMS |

| Purpose | It is used to send a detailed bill or invoice via text. | It allows customers to pay directly via text messages. | It provides information about a transaction or activity. |

| Payment Process | SMS invoicing follows a two-step payment process. 1) Open invoice 2) Complete payment |

SMS billing follows a one-step payment process. The customer replies to the SMS, and payment is processed. | No payment process is involved. |

| User Experience | It redirects to a webpage to complete the payment. | A customer can pay via SMS by clicking on a specific link or replying with a keyword. | A customer receives information about a transaction or activity. |

| Customer Input Required | Moderate. Customers will open the message, review it, click on the web link, and make payment | Low because customers just need to give a reply or click on a link. | None |

| Compliance Requirement | Yes, customers must opt-in to receive SMS. | Yes, customers must approve payment via SMS. | Yes, for privacy and consent. |

| Suitable For Recurring Payments? | No, not ideal. | Yes, it’s very effective. | No, not ideal. |

| Best Used For | Detailed and itemized billing requirements | Perfect for quick, regular, or one-tap payment. | Confirm orders, appointments, or updates. |

| Example | “Your invoice for $100 is ready. Pay here :[Link].” | “Click on this [Link] to pay $100 for your monthly subscription.” | “Your order #43675 has been shipped.” |

In short, if you want to let your customers pay via simple replies, then use SMS billing. If you want to send a detailed invoice, use SMS invoicing. And, if you’re going to send a confirmation or alert only, use a transactional SMS.

Now that you understand the difference between these three, let’s understand how SMS billing works.

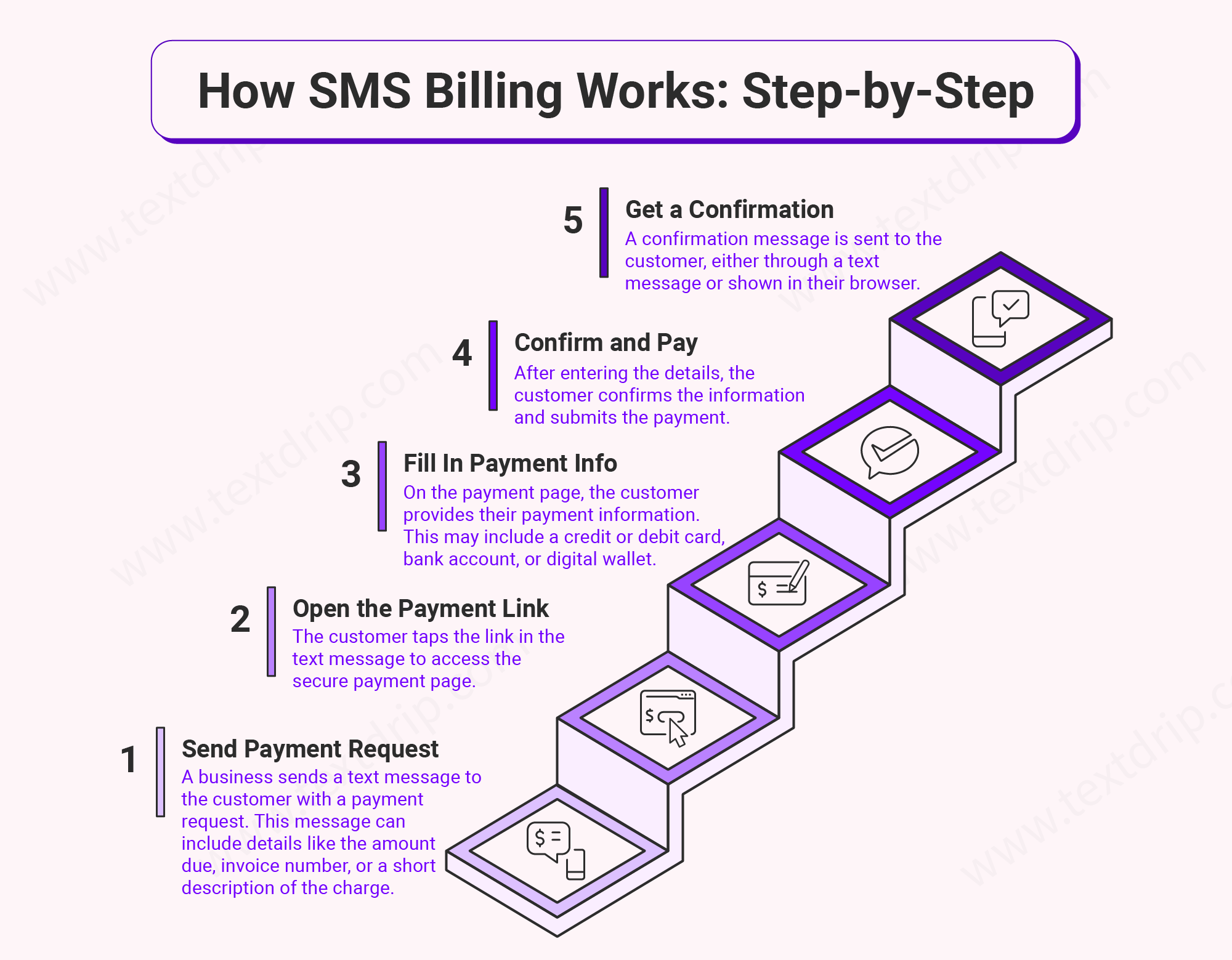

Here is a quick breakdown of how the text payment process works for businesses.

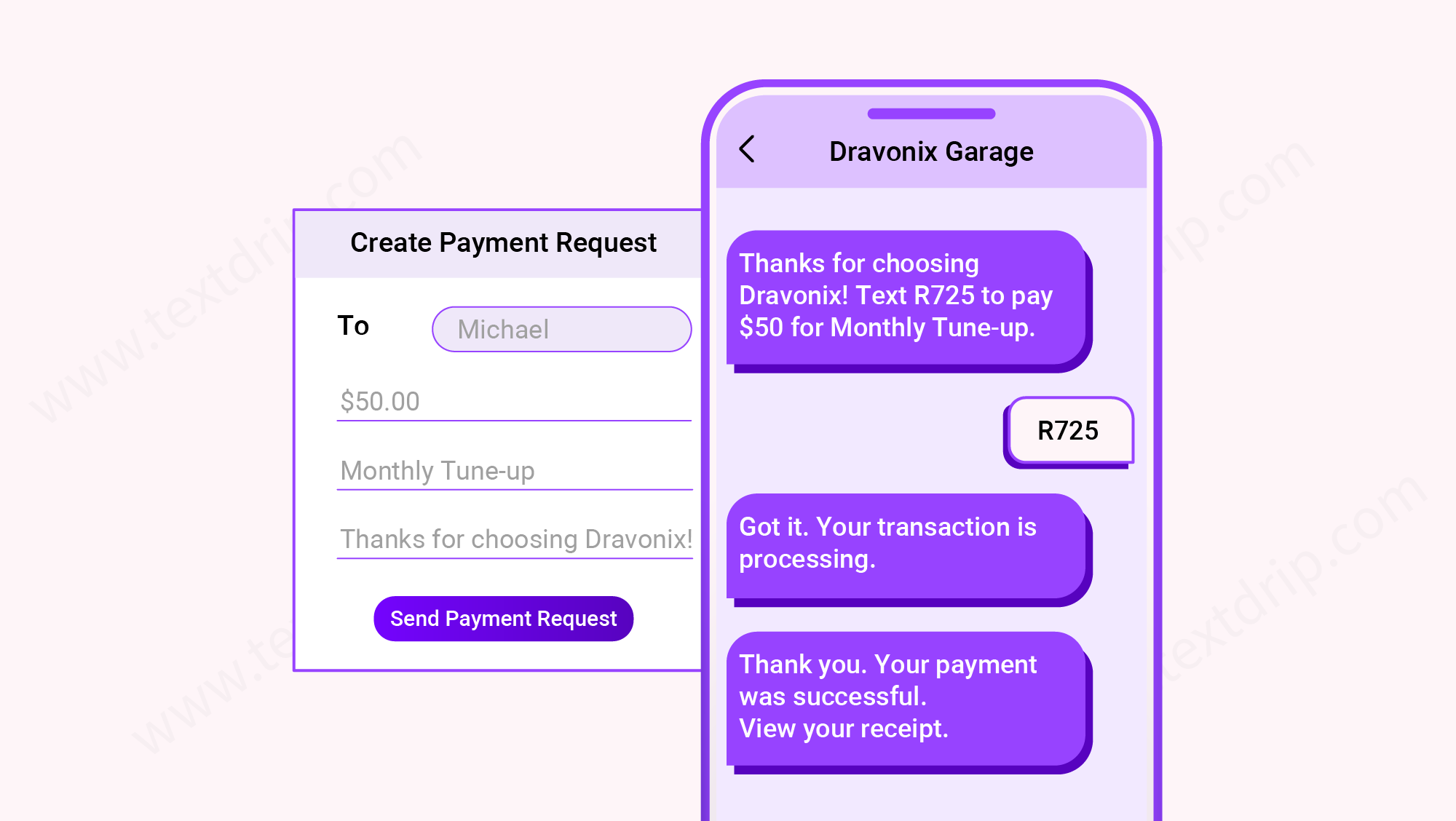

Before any business collects bill payments via SMS, they need to set up Text-to-Pay functionality. For that, they need a registered phone number for sending business SMS and an SMS billing system that offers a feature such as Text-to-Pay.

Usually, the business receives the payment within a day or two. In short, pay by text message enables quick, real-time, and secure transactions and that too without apps, passwords, or complications.

Several tools work together to facilitate SMS billing. Let’s check them out.

All these tools work together in a good SMS billing system.

Here are some common use cases, along with SMS billing templates that businesses use across various fields.

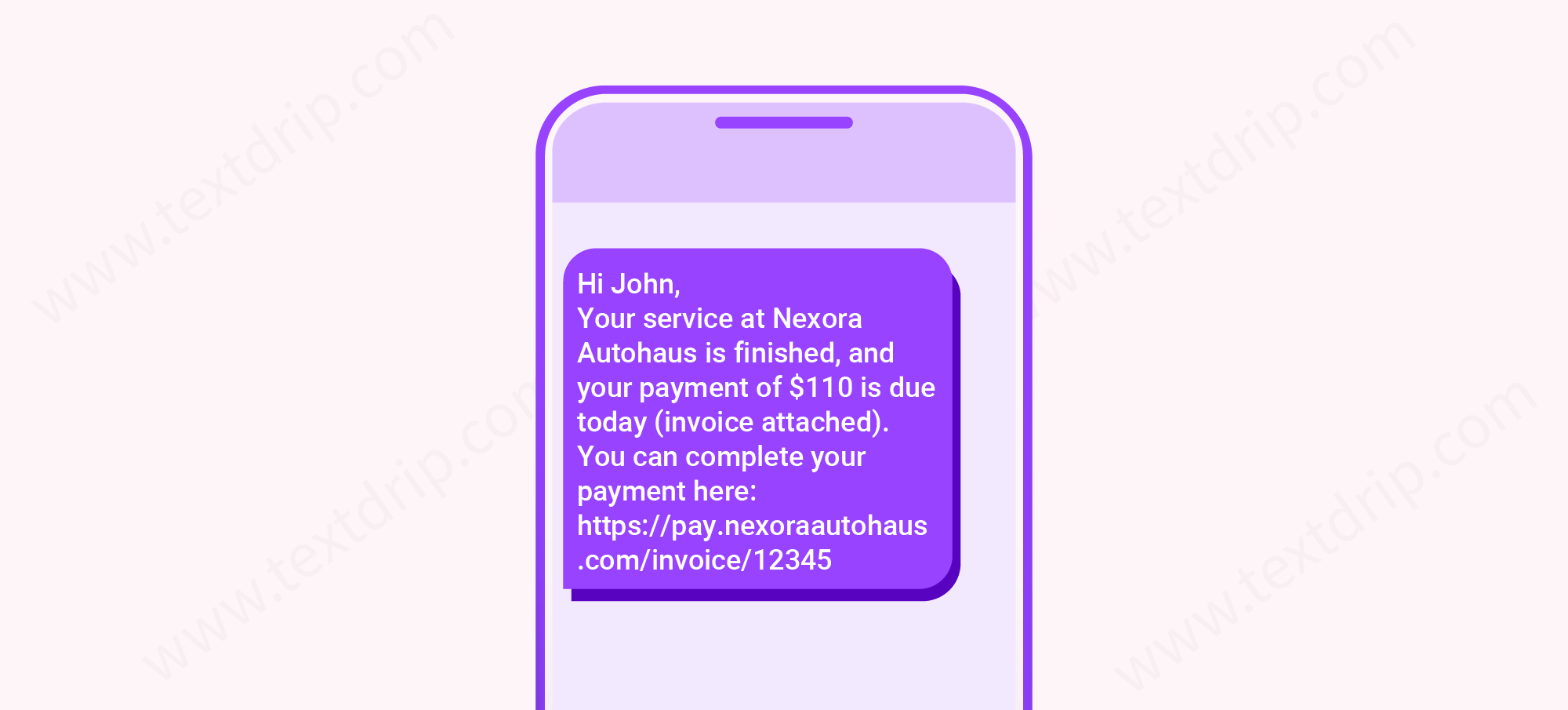

Businesses can include customer’s invoices and payment links in the same message to keep them informed and ease the billing process.

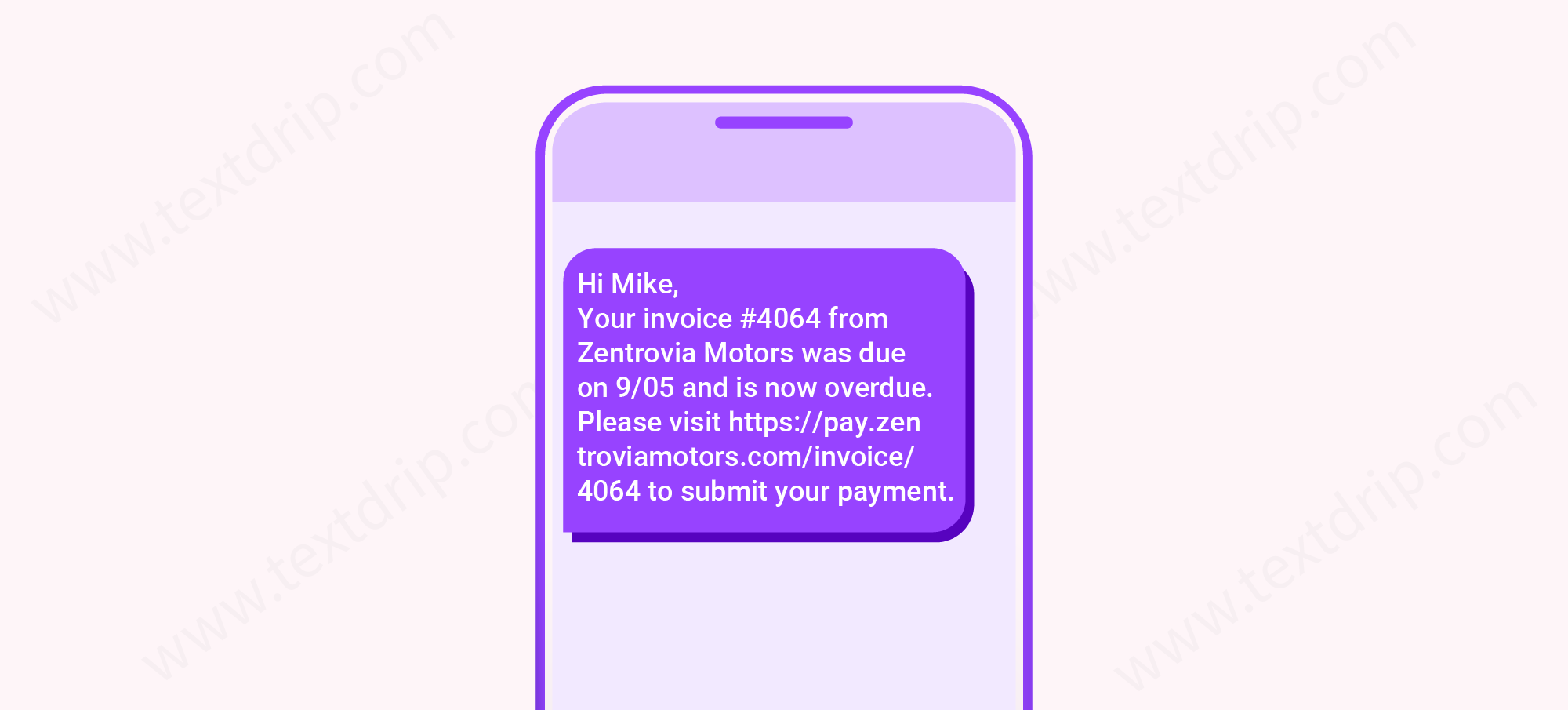

Businesses that want to cut down delays can send payment reminders via SMS. So customers won’t give “I forgot” excuses and can pay easily and quickly.

Send confirmation text messages to customers to ensure they know their payment has been successful. Don’t forget to attach the receipt for their record.

Businesses can use text messages to collect monthly subscription payments. Here is the SMS template that businesses can use.

Hey Mia, your monthly yoga subscription is due.

Click on this [Link] to pay $15 and continue enjoying classes.

Want to reduce no-shows? Use SMS to confirm appointments and collect fees in advance.

Hi, Emily, your dental appointment is confirmed for Friday.

Pay $30 in advance to confirm your appointment.

Reply PAY to complete your booking.

Are you into ecommerce business? You can send your customer the following message to receive the payment.

Hey Jack, thank you for shopping!

Click on this [Link] to pay $89 for your Bluetooth speaker.

Businesses planning to host an event can send the following message to increase bookings.

Hi Ema, reserve your spot for the cooking masterclass.

Click on this [Link] to pay $20 and get your ticket.

In short, there are three primary ways in which businesses can collect payments using SMS.

1. Send an SMS Link to Pay Online

Businesses can send an SMS link to customers so that they can click on the link and make the payment.

2. Transact Payment Through SMS

Businesses can use text messages as their payment processor, which is really helpful for getting paid faster without creating their own online payment portal.

3. Sending Notifications and Reminders

It is one of the most effective and simplest ways to use SMS for bill pay and collection.

There are several benefits of using text messages for sending billing requests. Here are just a few of them.

Yes, SMS payments are becoming the preferred method for recurring payments due to their high reliability, open rates, and engagement rates. Businesses can easily automate it, and most SMS billing systems come with built-in compliance features that provide opt-in/opt-out control, audit trails, and encryption protocols. It operates on the confirmation-reply model, so only users with access to their phone can authorize the payment. Therefore, if your business handles recurring payments, SMS billing can be your most effective conversion tool.

Nowadays, customers prefer convenience. They don’t want to deal with complicated website navigation or back-and-forth emails. Here is where SMS billing helps build trust, increase payment rates, and simplify operations. So, whether you’re a startup or an established business, text payment can save you time and improve your revenue.

Luckily, to use an SMS billing system, you don’t need to be tech-savvy. All you need is the right SMS payment solution, like Textdrip. It makes both your and your customer’s lives easier.

So, without giving it a second thought, start using SMS billing and improve your cash flow with Textdrip.

Businesses can integrate SMS billing by partnering with telecom providers or using third-party SMS payment solutions that offer APIs. These tools handle transaction authorization, messaging, and billing in compliance with local telecom regulations.

No, SMS billing works on any mobile phone capable of sending and receiving text messages. This makes text payment systems ideal for reaching users without smartphones or consistent internet access.

Direct carrier billing charges users through their phone bill, while SMS billing typically involves a payment confirmation or authorization via text. Both are forms of mobile payment, but SMS billing adds an interaction layer for added security.